Pay later options, consumers tend to think these are a new thing. However they have been around for longer than people might think. What better example, is that long ago before the Fashion Circle, back in 2014 we were approached by Wonga, to offer probably the first Pay Later on site as an option. And its was a roaring success, both for customers increasing revenue and for us not having to chase credit payments it was a win, win. Sounds great, until you read back and see the word Wonga. Not great and you know what happened there...

So with it being such a great success, it was thought - it can't be that hard to implement and manage ourselves. So after going through all the legal processes and so forth we set up our own version. Low and behold it was a nightmare. Fast forward 7 years and loads of Pay Later options have sprung up, so the question has now turned to which one rules the roost.

We've looked at results from the most well known providers in a case study across the last 30 days to find the answer, but first who are these companies, and what are their USP's?

Meet the contenders

Klarna. Founded in 2005 in Stockholm, Sweden with the aim of making it easier for people to shop online. With Klarna their options to pay instalments, include over 3 monthly payments or after 30 days. Making them the longest period offered for credit.

Clearpay. Set up six years ago in Sydney, Australia, Clearpay has millions of global customers and tens of thousands merchant partners now using the platform globally across Australia, US, Canada, the UK and EU and New Zealand. They offer a split of 4 instalments to be paid fortnightly weeks until the balance is cleared.

Laybuy. An innovative, fully integrated payment platform designed with simplicity at its core. Coming in at stretching instalments over 6 weeks, this means that Laybuy offers the lowest payments from all three providers.

The results are in

With all the excitement of the Jerry Springer show, there has been a shock surprise.

Before I even looked at the results, I would have gone straight in with Klarna as an outright winner. They are the biggest, and most visible with major advertising, but we were wrong (let us know if you thought this too).

We saw that Clearpay had taken the top spot, with twice the revenue of Klarna coming in at a distant second. Third place went to the lesser known LayBuy. Now obviously this was just an initial review, and their are so many demographics that could be applied to yield better results for different websites.

The best part of this however, is that it shows Pay Later is a much sort after service and, we would recommending implementing all of the big three providers as here are no upfront costs, and as payment choice is very much a personal and individual decision, having too much choice will definitely help conversion for customers that require these options.

Other benefits

Marketing Days. All the providers we've looked at have their own special days, where discounts and incentives are offered you use them, like Laybuymania and Clearplay day. This increases awareness for the Pay Later options and also gives your business a chance to appear on there website and other marketing material, increasing traffic and revenue during these periods.

Pay later day's such as 'Clearpay Day' encourage shoppers to show loyalty to their preferred Lay later option

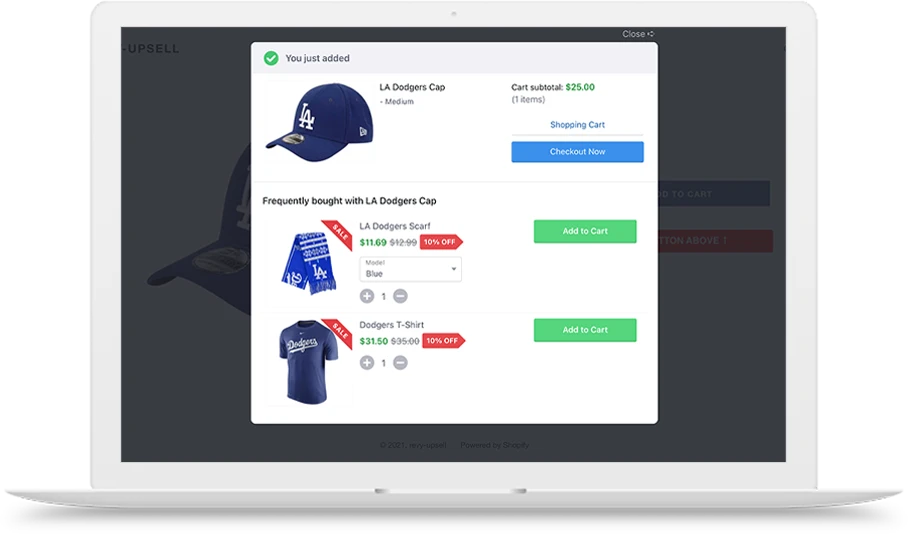

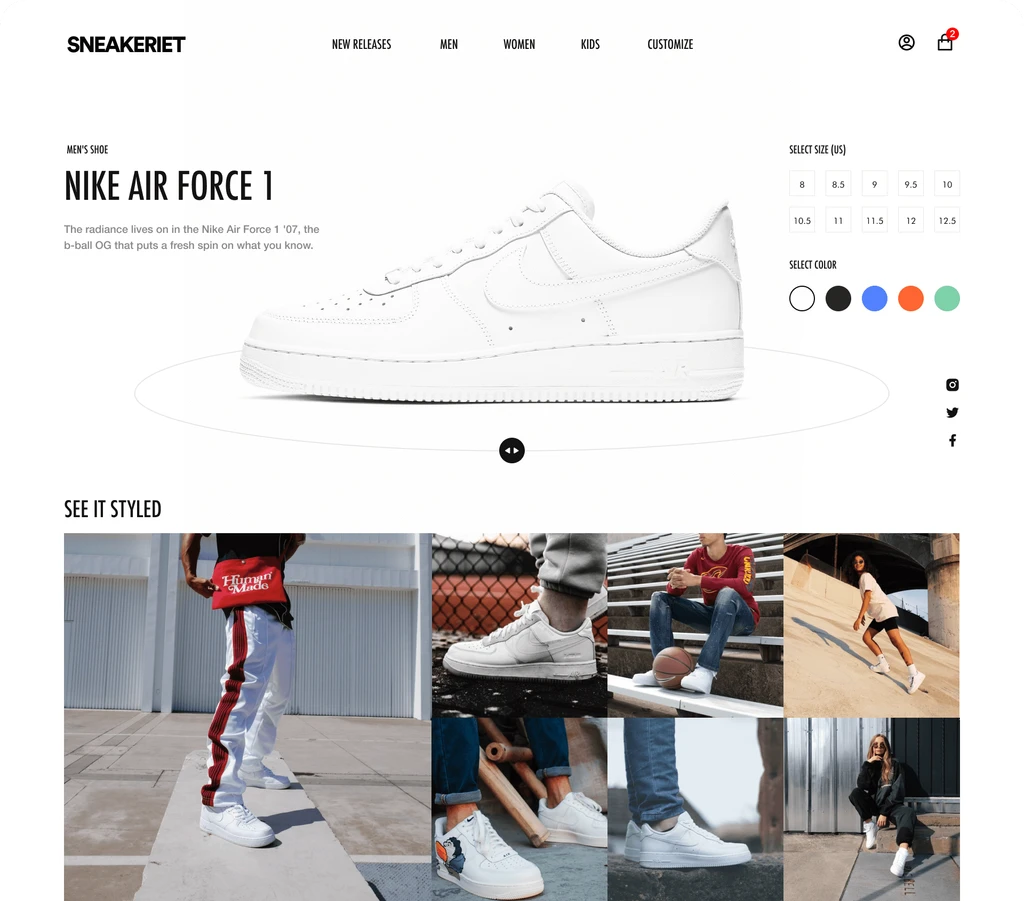

Onsite messaging. The carrot stick waving. Having the price breakdown for the instalments on the product page for your, increases conversion. It's a no brainer.

Where do I start?

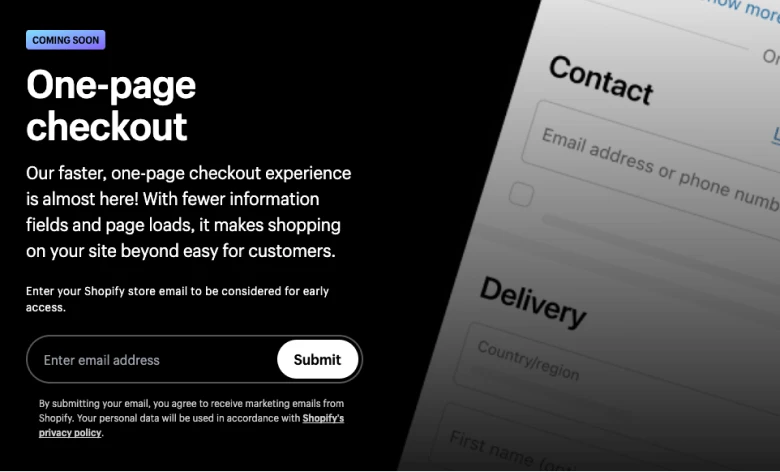

The decision is easy to go forward with Pay Later options, but the implementation can be tricky. Especially for example, trying to get all the onsite messaging for multiple providers on your product page, to match up with your theme. However you need assistance, the Fashion Circle can provide it, I mean we were right there at the beginning, so better to assist you.

Share this article:

John Lewis X Shopify Integration

Reviews, Reviews, Reviews